Aligning all partners across the entire insurance ecosystem

A personalized approach.

Challenges

Many P&C insurance carriers often rely on legacy systems, solutions, and processes that drive up operational costs and limit flexibility and capacity to meaningfully support their distribution partners and policyholders.

The inability to provide resources to identify and prevent losses at scale, lowers acquisition and retention rates and inhibits actionable insights for data-driven decision making and underwriting profitability. iLE helps to close the gaps.

Solutions

AI Risk Management

Our comprehensive AI-powered risk management solutions and services are focused on expanding the ability of P&C providers to scale their service into traditionally under-served and specialty markets.

Stakeholder Support

iLE helps creates valuable new data assets to help strategic decision making, underwriting profitability, and improve resource allocation across the insurance value-chain.

Purpose-built Solutions

We increase competitive differentiation through purpose-built solutions that reduce the frequency or severity of claims through proactive risk prevention and analysis.

Challenges

The insurance market is rapidly evolving with an increasing use of technology, an emerging and complex business risk landscape and rising customer expectations. More than ever, trusted advisors are needed by clients to help navigate the risks.

Unfortunately, many insurance businesses do not have the capacity or the resources to support their clients at scale, leaving money on the table with high customer churn and operating expenses. iLE has the solutions to help such challenges faced by Producers.

Solutions

Client Engagement

Improved Acquisition Rates & Retention

We help our producer partners improve acquisition and retention rates by establishing competitive differentiation with valuable client services to help reduce client losses and secure underwriting favorability.

Reduced Operational Costs

Challenges

This is where iLE can help business leaders in the insurance ecosystem by keeping them and their enterprises always ahead of the curve.

Solutions

Simplify Processes

Train and Upskill Employees

We reduce the high administrative burden of onboarding, training, upskilling and retaining employees is reduced, thereby reducing costly operational processes.

Maintain Compliance

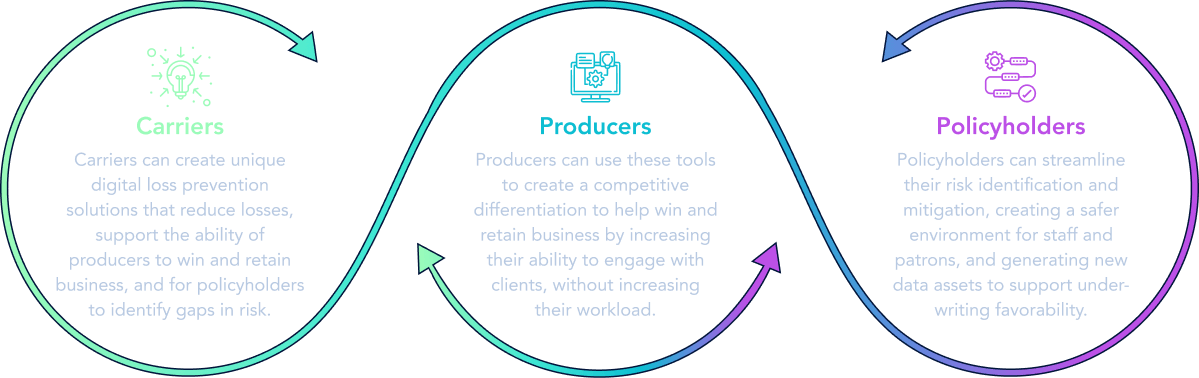

Impact Circle

How we help clients across the insurance industry

Unlock your competitive advantage with iLE